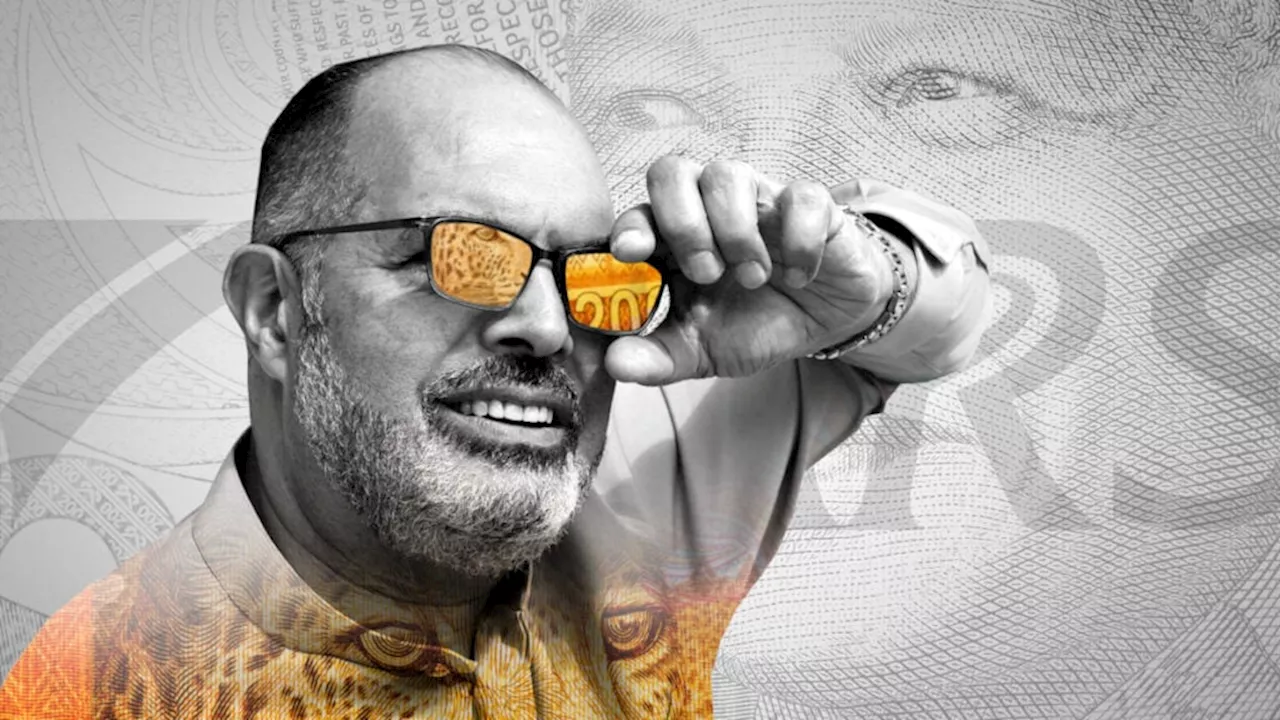

SARS expects you to pay tax on earnings from crypto gambling, trading and mining

Lost your password? Please enter your username or email address. You will receive a link to create a new password via email.When it comes to crypto taxes in South Africa, it is crucial for any beginner to understand the basics. The South African Revenue Service treats cryptocurrencies as “assets of an intangible nature” and not currency or property, which means that they are subject to capital gains tax or income tax, depending on how they’re used.

When it comes to trading cryptocurrencies, SARS treats these transactions as barter exchanges, which are taxed at 18%. This means that the fair market value of the exchanged currency is considered the amount taxable. For example, if you tradefor Ethereum, the market value of the received Ethereum is considered the taxable amount. Using crypto to make any payments to acquire goods or services is also considered a barter transaction and is taxed accordingly.

South Africa Latest News, South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

SARS clamps down hard on crypto traders: What you need to knowRecent developments have seen the South African Revenue Service (SARS) turn its attention toward crypto traders.

SARS clamps down hard on crypto traders: What you need to knowRecent developments have seen the South African Revenue Service (SARS) turn its attention toward crypto traders.

Read more »

Two-pot retirement system: South Africans, unions unhappy about Sars’ tax deductionsWhile people were excited about the implementation of the two-pot retirement system, they now face the reality of paying tax on withdrawals.

Two-pot retirement system: South Africans, unions unhappy about Sars’ tax deductionsWhile people were excited about the implementation of the two-pot retirement system, they now face the reality of paying tax on withdrawals.

Read more »

SARS warning over eFiling fraud in South AfricaSARS has denied any internal shenanigans in the latest reports of eFiling fraud—warning that the threat is coming from highly sophisticated syndicates.

SARS warning over eFiling fraud in South AfricaSARS has denied any internal shenanigans in the latest reports of eFiling fraud—warning that the threat is coming from highly sophisticated syndicates.

Read more »

SARS is coming after taxpayers in South Africa hard with new ‘masterstroke’ moveSARS is upping the ante against tax dodgers in South Africa by tapping into a new source of skills and expertise.

SARS is coming after taxpayers in South Africa hard with new ‘masterstroke’ moveSARS is upping the ante against tax dodgers in South Africa by tapping into a new source of skills and expertise.

Read more »

SARS warms up to rich South AfricansSARS is offering top-shelf services to wealthy South Africans—but on condition that the taxman can take a closer look into their affairs.

SARS warms up to rich South AfricansSARS is offering top-shelf services to wealthy South Africans—but on condition that the taxman can take a closer look into their affairs.

Read more »

SARS is coming after these companies in South AfricaCompanies in South Africa are frustrating the taxman by not putting the right officials in place – so SARS is proposing changes to make it difficult to avoid.

SARS is coming after these companies in South AfricaCompanies in South Africa are frustrating the taxman by not putting the right officials in place – so SARS is proposing changes to make it difficult to avoid.

Read more »