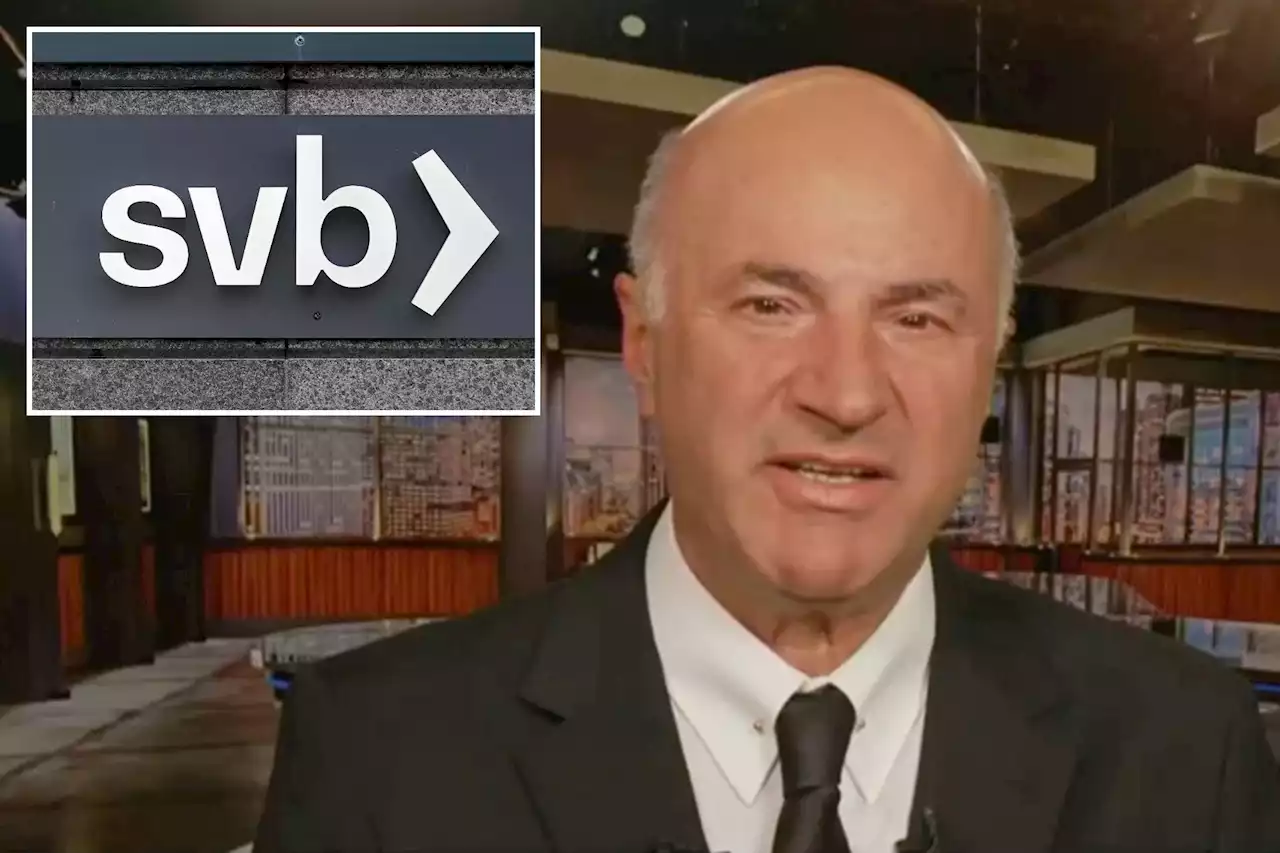

'Shark Tank' investor Kevin O'Leary says he's telling startup CEOs to limit bank deposits and brace for the next 'black swan idiot' blowup

and fears of a 1980s-style banking crisis, but he problems are less systemic and more due to the"idiot management" at SVB, and an"incompetent board" that"knew nothing about banking," O'Leary said.

He added that assets of some his own companies were tied up in the bank, though he didn't disclose the total amount. In particular, O'Leary blasted the SVB's high exposure to long-term bonds. Bond prices have sunk over the past year amid the Fed's interest rate hikes to control inflation, leading torisk of contagion from Silicon Valley Bank's fallout

is low, but O'Leary remains concerned over the impact of regulators' response to the crisis, making all of SVB and Signature Bank's depositors whole, even above the typical $250,000 deposit threshold. That upends the FDIC's usual standards for deposit insurance, and it inherently makes bank stocks more risky, O'Leary said, as bank managers may now feel free to take on more risk to boost stock prices, even if it endangers the safety of deposits. as the precedent set by SVB's collapse means the government has"nationalized" the sector. , another regional bank under pressure, by injecting $30 billion of deposits.

South Africa Latest News, South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

'Shark Tank' star Kevin O'Leary bashes SVB bailout, moves assets out of banksCelebrity investor Kevin O'Leary claims federal regulators should have let Silicon Valley Bank fail rather than 'panic' and change policy for the entire banking system.

'Shark Tank' star Kevin O'Leary bashes SVB bailout, moves assets out of banksCelebrity investor Kevin O'Leary claims federal regulators should have let Silicon Valley Bank fail rather than 'panic' and change policy for the entire banking system.

Read more »

Kevin O’Leary grilled on why he kept money at SVB if management were ‘idiots’The ‘Shark Tank’ star admitted he had “many companies” with funds tied up in Silicon Valley Bank.

Kevin O’Leary grilled on why he kept money at SVB if management were ‘idiots’The ‘Shark Tank’ star admitted he had “many companies” with funds tied up in Silicon Valley Bank.

Read more »

Black founders who banked with SVB fear backsliding on hard-won gainsSilicon Valley Bank earned mostly good reviews from entrepreneurs of color who recalled strained alliances with the financial industry. The collapse has struck some as a potentially lasting setback.

Black founders who banked with SVB fear backsliding on hard-won gainsSilicon Valley Bank earned mostly good reviews from entrepreneurs of color who recalled strained alliances with the financial industry. The collapse has struck some as a potentially lasting setback.

Read more »

'Mr. Wonderful' torches 'idiot' bankers, says feds' SVB response 'nationalized the banking system'Kevin O'Leary, the Boston investor best known for his venture capitalism on 'Shark Tank,' joined Sean Hannity to sound off on the collapse of Silicon Valley Bank.

'Mr. Wonderful' torches 'idiot' bankers, says feds' SVB response 'nationalized the banking system'Kevin O'Leary, the Boston investor best known for his venture capitalism on 'Shark Tank,' joined Sean Hannity to sound off on the collapse of Silicon Valley Bank.

Read more »

Investors bet SVB's crash means the Fed will slow rate hikesInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Read more »

SVB rescue means deposits in entire US financial system are guaranteedThe Silicon Valley Bank rescue means regulators have guaranteed deposits for the entire US financial system, Evercore founder Roger Altman says

Read more »