People should be on the lookout for shady tax preparers and watch for common warning signs, such as charging a fee based on the size of the refund. Other common scams are refusing to sign the return or asking people to sign a blank return.

The Internal Revenue Service is warning taxpayers to keep an eye out for fraudsters working as tax return preparers.

“Most tax professionals offer excellent advice and can really help people navigate complex tax issues. But we continue to see instances where taxpayers are “ghosted” by unscrupulous tax preparers with bad advice who quickly disappear,” said IRS Commissioner Danny Werfel in a press release. “We encourage taxpayers to check out the tools and resources available to them to ensure they find the right tax professional for their needs.”Check credentials of tax preparers.

Not signing the return could mean the preparer may be looking to make a quick profit by promising a big refund or charging fees based on the size of the refund. This leaves the taxpayer vulnerable and on the hook for any misinformation on the return. Taxpayers should never sign a blank or incomplete return.

South Africa Latest News, South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

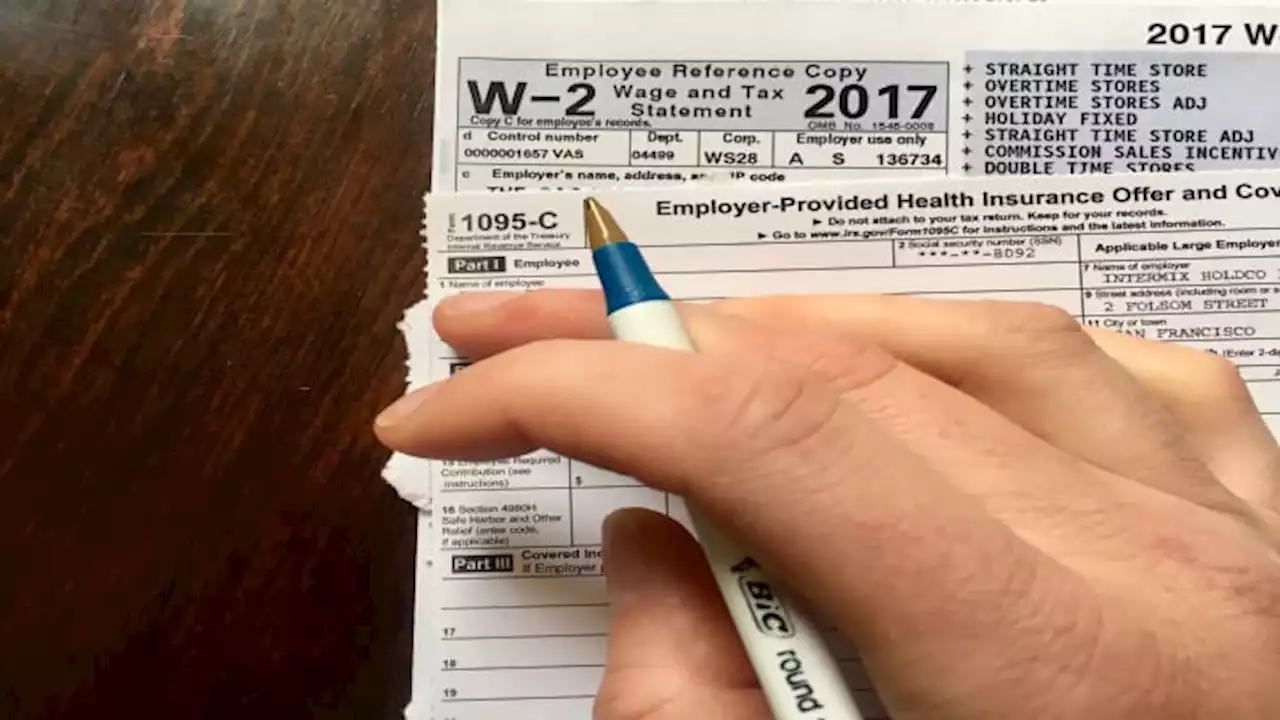

IRS tax warning: Don’t get tricked by these scams circulating on social mediaSeveral examples of how social media can circulate inaccurate or misleading tax information have been seen recently. These often involve common tax documents like Form W-2, the IRS said.

IRS tax warning: Don’t get tricked by these scams circulating on social mediaSeveral examples of how social media can circulate inaccurate or misleading tax information have been seen recently. These often involve common tax documents like Form W-2, the IRS said.

Read more »

How Will NFTs Be Taxed? Understanding the IRS' New Proposed GuidelinesLast week, the IRS published a document requesting comment and proposing new guidance on the tax treatment of NFTs in the U.S. megdematteo spoke to tax experts to understand the implications:

How Will NFTs Be Taxed? Understanding the IRS' New Proposed GuidelinesLast week, the IRS published a document requesting comment and proposing new guidance on the tax treatment of NFTs in the U.S. megdematteo spoke to tax experts to understand the implications:

Read more »

Tax season 2023: Tax preparers push to keep IRS from providing free filing serviceMultiple tax preparers are asking the IRS not to create its own free tax filing system because doing so would likely have a drastic effect on the tax preparing business.

Tax season 2023: Tax preparers push to keep IRS from providing free filing serviceMultiple tax preparers are asking the IRS not to create its own free tax filing system because doing so would likely have a drastic effect on the tax preparing business.

Read more »

Tax season 2023: IRS warns of scams aimed at high-income filersThe IRS has issued a warning for high-income taxpayers regarding various scams targeted at them as the end of tax season draws near. The IRS's latest warning is a continuation of its 'Dirty Dozen' series, 12 different types of tax scams.

Tax season 2023: IRS warns of scams aimed at high-income filersThe IRS has issued a warning for high-income taxpayers regarding various scams targeted at them as the end of tax season draws near. The IRS's latest warning is a continuation of its 'Dirty Dozen' series, 12 different types of tax scams.

Read more »

Here's why IRS tax audits have declined over the past decadeFunding for the IRS has been squeezed for the past 10 years, which has correlated with a decline in audit rates across all tax brackets.

Here's why IRS tax audits have declined over the past decadeFunding for the IRS has been squeezed for the past 10 years, which has correlated with a decline in audit rates across all tax brackets.

Read more »