This article examines retail sentiment on the British pound and positioning on three key FX pairs: GBP/USD, GBP/JPY and EUR/GBP. In the piece, we also investigate potential market outcomes guided by technical contrarian signals.

Naturally, contrarian signals aren't foolproof. They become most powerful when combined with a well-rounded trading plan. By carefully incorporating contrarian signals alongside technical and fundamental analyses, traders develop a richer understanding of the market's underlying dynamics – aspects that the majority might easily miss.

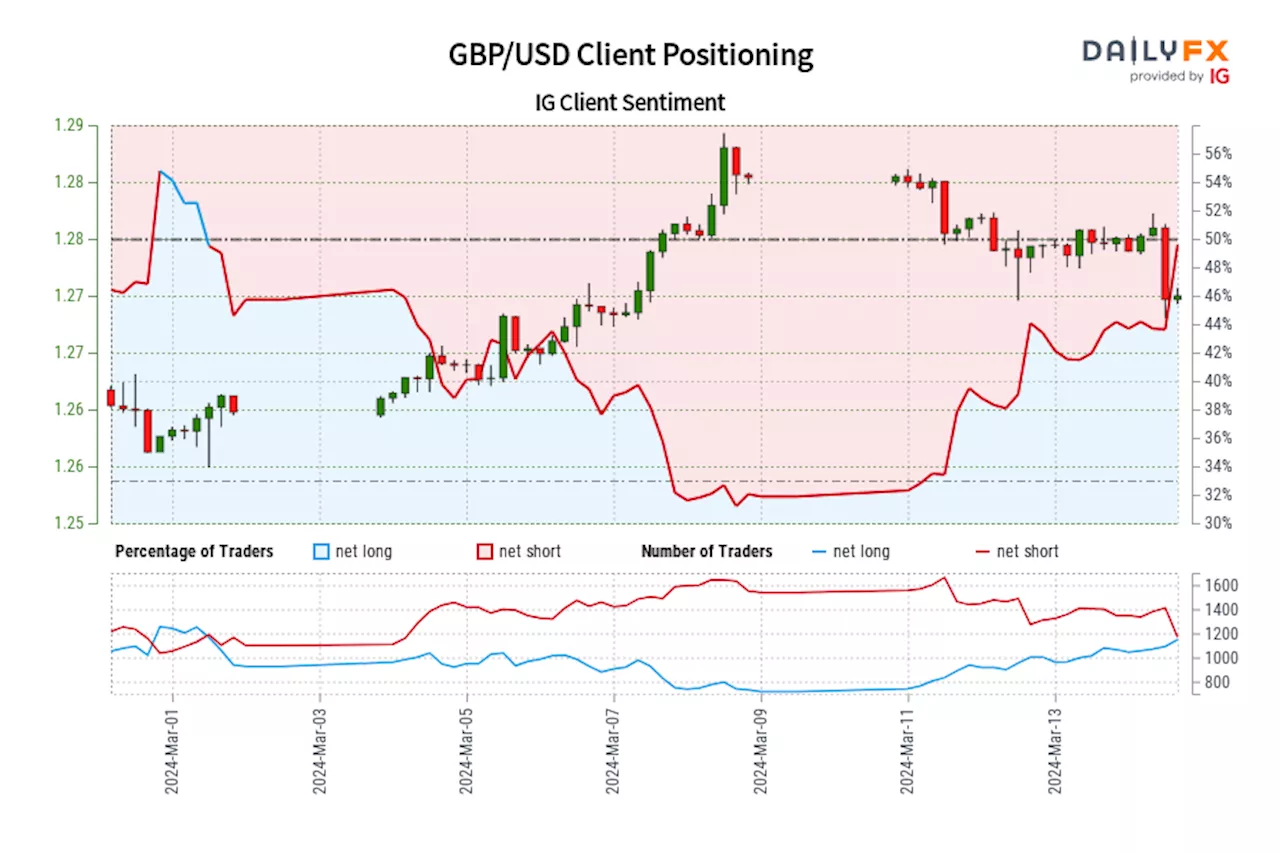

With our unique interpretation of crowd behavior, the current dominance of bullish positions suggests a possible extension of GBP/USD's weakness. The substantial increase in net long wagers and changes in market positioning on various timeframes reinforces our bearish contrarian bias on GBP/USD. This means a move below 1.2500 could be around the corner.

Our approach often favors a contrarian viewpoint. This prevalent pessimism towards GBP/JPY hints at potential upside for the pair. The continued net-short positioning further strengthens this bullish contrarian outlook.Remember, contrarian signals offer a unique perspective but should always be considered alongside technical and fundamental analysis for a comprehensive trading strategy.IG data indicates that the retail crowd maintains a bullish bias towards EUR/GBP, with 67.

South Africa Latest News, South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

British Pound Outlook & Market Sentiment – GBP/USD, GBP/JPY, EUR/GBPThis article scrutinizes retail sentiment on the British pound across three key FX pairs: GBP/USD, GBP/JPY and EUR/GBP, while also examining unconventional scenarios that challenge common crowd behaviors in the market.

British Pound Outlook & Market Sentiment – GBP/USD, GBP/JPY, EUR/GBPThis article scrutinizes retail sentiment on the British pound across three key FX pairs: GBP/USD, GBP/JPY and EUR/GBP, while also examining unconventional scenarios that challenge common crowd behaviors in the market.

Read more »

British Pound Q2 Technical Outlook - GBP/USD, EUR/GBP, and GBP/JPY Technical OutlooksThe British Pound has started the process of re-pricing against a range of currencies after the Bank of England’s shift in tone

British Pound Q2 Technical Outlook - GBP/USD, EUR/GBP, and GBP/JPY Technical OutlooksThe British Pound has started the process of re-pricing against a range of currencies after the Bank of England’s shift in tone

Read more »

Sterling Outlook: GBP/USD, EUR/GBP, GBP/JPY Setups Ahead of CPISterling remains one of the better performers against the dollar this year with the BoE less dovish than the Fed – something that could improve its interest rate differential

Sterling Outlook: GBP/USD, EUR/GBP, GBP/JPY Setups Ahead of CPISterling remains one of the better performers against the dollar this year with the BoE less dovish than the Fed – something that could improve its interest rate differential

Read more »

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

GBP/USD IG Client Sentiment: Our data shows traders are now net-long GBP/USD for the first time since Mar 01, 2024 when GBP/USD traded near 1.26.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Read more »

EUR/GBP trims gains after British inflation data, BoE decision loomsThe EUR/GBP is currently experiencing mild gains, trading at 0.8541 after peaking at a high of 0.8560.

EUR/GBP trims gains after British inflation data, BoE decision loomsThe EUR/GBP is currently experiencing mild gains, trading at 0.8541 after peaking at a high of 0.8560.

Read more »

GBP/USD Price Analysis: Subdued around 1.2700, with bears in charge pre-FOMC decisionThe Pound Sterling drops some 0.12% against the US Dollar in early trading during the North American session as traders brace for the Federal Reserve’s monetary policy.

GBP/USD Price Analysis: Subdued around 1.2700, with bears in charge pre-FOMC decisionThe Pound Sterling drops some 0.12% against the US Dollar in early trading during the North American session as traders brace for the Federal Reserve’s monetary policy.

Read more »