Responses range from celebration to criticism

A major American bank has launched a new program to help first-time minority buyers finance a home purchase with

or closing costs. It’s a boon to buyers at a time when rising interest rates and low home inventory have stacked the deck against them.Sign up to receive the daily top stories from the Financial Post, a division of Postmedia Network Inc.By clicking on the sign up button you consent to receive the above newsletter from Postmedia Network Inc. You may unsubscribe any time by clicking on the unsubscribe link at the bottom of our emails. Postmedia Network Inc.

Crucially, the program also requires no minimum credit score, with eligibility focused instead on a borrower’s solid track record of rent payments and regular monthly bills like utilities and phone. Before applying, buyers must finish a homebuyer certification course that counsels them on ownership responsibilities and other considerations.

But the move quickly drew mixed responses online, as Bank of America have been criticized in the past for predatory lending practices — especially when loaning to minority groups.

South Africa Latest News, South Africa Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

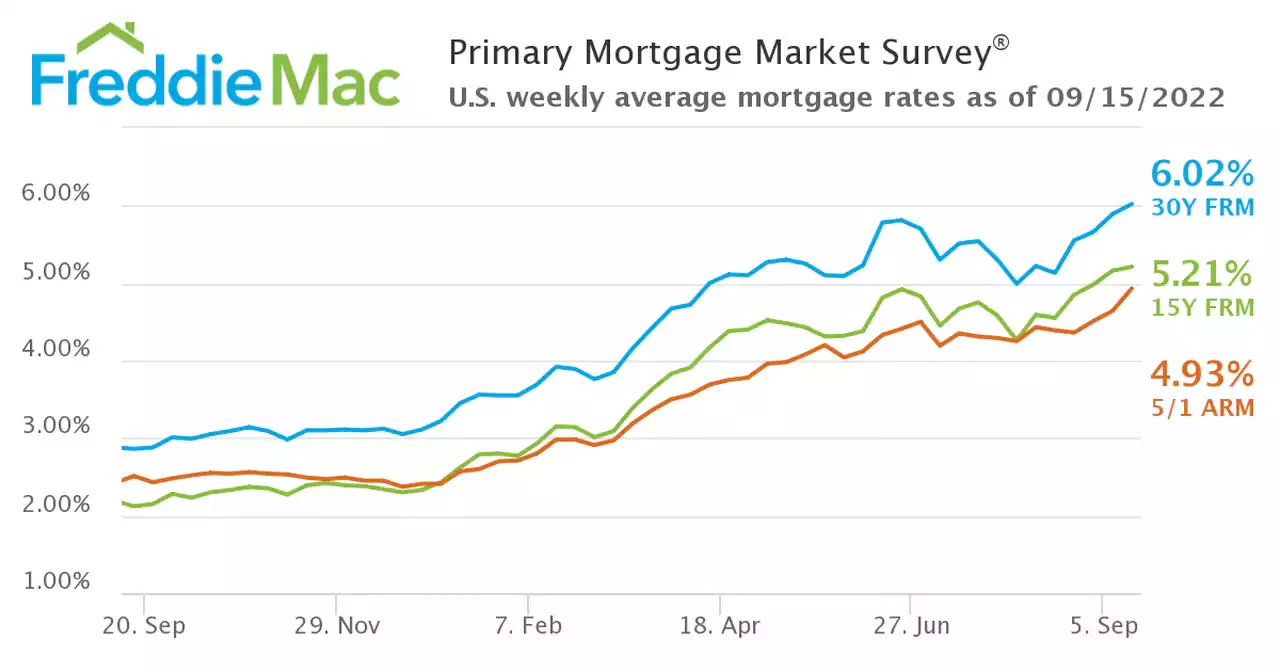

Mortgage rates top 6% for the first time since 2008Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Mortgage rates top 6% for the first time since 2008Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Read more »

Mortgage rates top 6% for the first time since 2008 | CNN BusinessMortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Mortgage rates top 6% for the first time since 2008 | CNN BusinessMortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Read more »

30-year mortgage rates top 6% for first time since 2008Less than a year removed from historically low interest, the average rate on a 30-year fixed rate mortgage nationally is now higher than its been since 2008.

30-year mortgage rates top 6% for first time since 2008Less than a year removed from historically low interest, the average rate on a 30-year fixed rate mortgage nationally is now higher than its been since 2008.

Read more »

Pressure builds on housing market as mortgage rates cross 6%, a first since 2008Mortgage rates crossed the 6% threshold and hit their highest point since 2008, upping the pressure on the U.S. housing market and pricing out even more would-be homebuyers.

Pressure builds on housing market as mortgage rates cross 6%, a first since 2008Mortgage rates crossed the 6% threshold and hit their highest point since 2008, upping the pressure on the U.S. housing market and pricing out even more would-be homebuyers.

Read more »

Mortgage Rates Climb Above 6% for First Time Since 2008The jump in mortgage rates means if someone purchased a million dollar home now compared to January 1, they would be paying $1,400 more a month in interest.

Mortgage Rates Climb Above 6% for First Time Since 2008The jump in mortgage rates means if someone purchased a million dollar home now compared to January 1, they would be paying $1,400 more a month in interest.

Read more »

Home mortgage rates rise to 6% for first time since the 2008 housing crashThe interest rate hike threatens to sideline even more homebuyers from a cooling housing market.

Home mortgage rates rise to 6% for first time since the 2008 housing crashThe interest rate hike threatens to sideline even more homebuyers from a cooling housing market.

Read more »